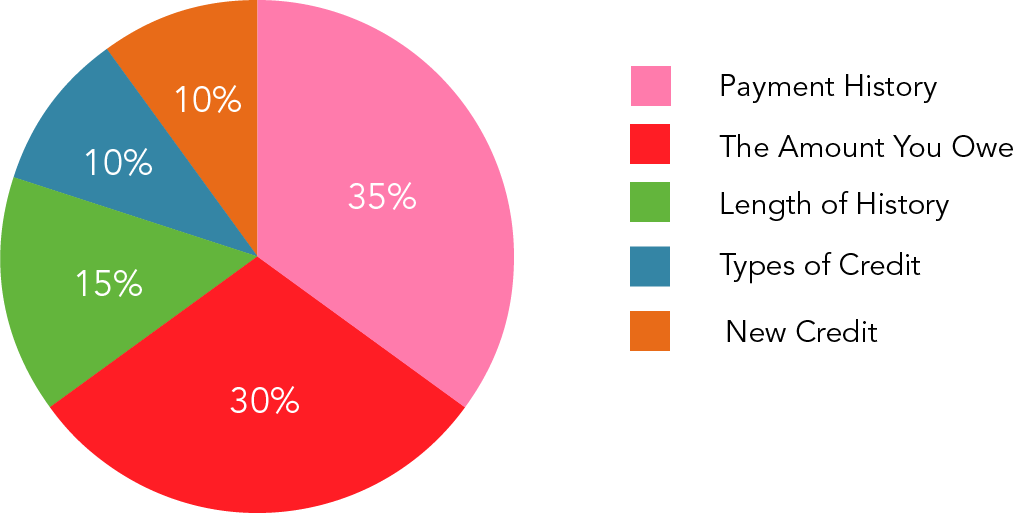

A credit score is simply a "grade" based off of the details of your credit report. Your credit score number is an easy way for banks, insurance companies, landlords and employers to decide if giving you a loan, policy, apartment, or job is a safe choice or a risk for them. Scores typically range from 300 to 850 with a multitude of factors going into the final decision of your score.

Latest Blog Posts

Credit reports and credit scores are a vital part of your financial health, but how we do understand the differences between the two and why is each so important? We'll break it down for you.

Topics: Making a Big Purchase, Managing Your Money

According to recent statistics regarding student debt in our country, Americans owe over $1.4 trillion in student loan debt, which is spread out among nearly 44 million borrowers. Furthermore, the average amount of student loan debt for a graduate of the Class of 2016 was approximately $37,172, up six percent from the previous year. (Sources via: WSJ, and federalreserve.org)

Topics: Managing Your Money