Credit reports and credit scores are a vital part of your financial health, but how we do understand the differences between the two and why is each so important? We'll break it down for you.

When applying for a credit card , a student loan, a mortgage, or a car loan, your credit score and credit report help lenders lessen their risk of not being paid as agreed. Credit reports are information about your past and current credit agreements. They keeps track of how long accounts have been open, how much you owe creditors, and your consistency of making on-time payments. A credit score is essentially a "grade" reflecting your credit report.

Credit reports provide an extensive list of your credit and payment history, but they do not contain your specific credit score. Credit reports give a detailed description of all the accounts you have ever opened/closed, loans you've taken out, and how you have paid off your outstanding balances. Instances such as debt or bankruptcy will appear here as well. It is crucial to build your credit history as lenders, employers, insurers, and landlords all use credit reports to evaluate your eligibility for loans, insurance policies, and lease agreements.

Lenders look at credit scores to get a better idea of how risky or safe someone is before approving a loan. Credit scores are derived from information compiled in your credit report. Some of the most important components include:

- your repayment history (whether you have degrading marks for being late or defaulting)

- your owed money compared to your credit limits (credit utilization ratio)

- recent applications for credit (hard inquiries)

- how long you've had credit accounts, and the types of credit that you have

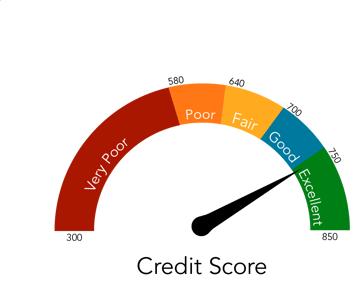

Typically, your credit score will range from 300 to 850 with scores over 690 usually considered "good" and scores over 720 considered "excellent". It is important to keep track of your score and to keep it in the higher range as the lender will check your credit score to determine your eligibility and interest rate. A high credit score indicates a lower risk for the lender so a customer with a higher credit score is more likely to qualify for a loan as well as receive a lower rate; however, some lenders use a more holistic approach and include other factors - such as an existing relationship (other accounts with lender) and how long you've been with your current employer - when making an approval decision.

You can get a FREE copy of your credit report once a year from each of the three major credit bureaus - Equifax, Transunion, and Experian - by visiting annualcreditreport.com, calling 1-877-322-8228, or completing the Annual Credit Report Request Form and mailing it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.