A credit score is simply a "grade" based off of the details of your credit report. Your credit score number is an easy way for banks, insurance companies, landlords and employers to decide if giving you a loan, policy, apartment, or job is a safe choice or a risk for them. Scores typically range from 300 to 850 with a multitude of factors going into the final decision of your score.

Breaking Down Credit Scores

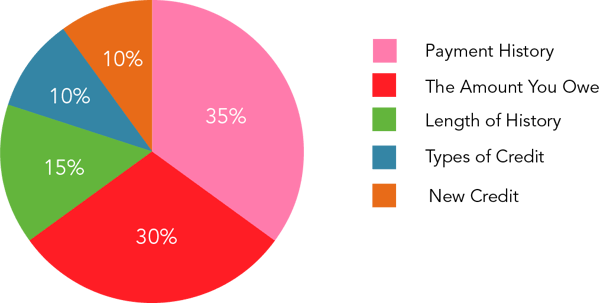

While there isn't a lot amount of information released on how exactly each score calculated, the basic categories and their importance are as follows:

Payment history (35%)

Your track record of whether you pay bills on time or not, carries the heaviest weight of all the categories because it lets lenders know the chances of whether or not you will repay loans on time.

Amount You Owe (30%)

Debt carries the second largest amount of weight. While a small amount of debt won't completely ruin your credit score, there are ways you can show you manage it responsibly. For example, you should try to keep your credit card balances below 10% of your credit limits.

Length of History (15%)

The age of your credit, keeps track of the age of your accounts and how you have managed them during the time that they've been open.

Types of Credit (10%)

There are usually two main types of credit:

- revolving credit - such as credit cards or lines of credit

- installment accounts - auto loans, mortgages, student loans, and personal loans

New Credit (10%)

This category tracks when your credit reports are pulled and reviewed, also called credit inquiries. The number of inquires you have on your credit report lets lenders know how often you're shopping for credit. It is based off of hard inquiries, which requires your consent to pull your credit report. A hard inquiry may impact your credit scores and stay on your credit reports for about two years. By contrast, soft credit inquiries, which can be pulled without your knowledge, don’t affect your scores the same way.

Understanding what's in your credit report can be just as important as your credit score. Read our blog post about the differences between credit scores and credit reports here.