What is the Snowball Method?

The snowball method is a way for people to become motivated to pay off their debt by paying the smallest amount first and the largest amount last. Instead of trying to hack away at your largest debt and feeling like you've made no progress, paying off the smallest debt and applying that amount to the next debt makes it easier for people to see the progress they are making.

How it Works:

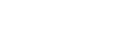

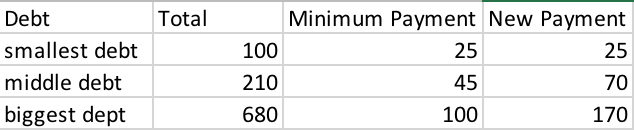

To start the snowball method, you need to lay out all of your debts and order them from the least expensive to the most expensive along with the interest you pay on each every month. Make sure you finance to cover the minimum monthly payments needed for each debt. With the spare money you have, try to pay off your smallest debt first. Once that smallest debt is paid off then take the minimum amount you were paying monthly on the smallest debt and apply the same process the next smallest debt. For example, if you were paying $25 as a monthly minimum on your smallest debt and you were sending extra money to pay off that debt.

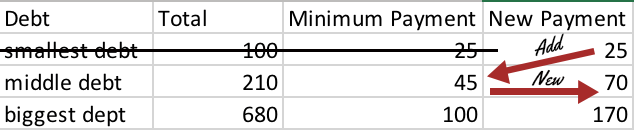

When you pay it off, you would start putting that monthly minimum towards your next debt as well. So if your second smallest debt was having you pay $45 a month, then you would pay that monthly minimum and add on that extra $25 that you were already spending, making the monthly payment towards that one debt $70 a month. You keep repeating that process, paying the same amount every single month, but you can see how much all those numbers would add up by the end. This ultimately makes it less daunting to start attacking those bigger bills.

Why This Works:

A lot of the time people feel discouraged because they are trying to pay their biggest debt first and while they're working on that, other miscellaneous debts get thrown into the mix. Everything keeps piling up and they feel as if they have made no progress. With the Snowball Method, you can start checking debts off your list much sooner and it becomes less overwhelming. You are actually able to see the progress that you're making.